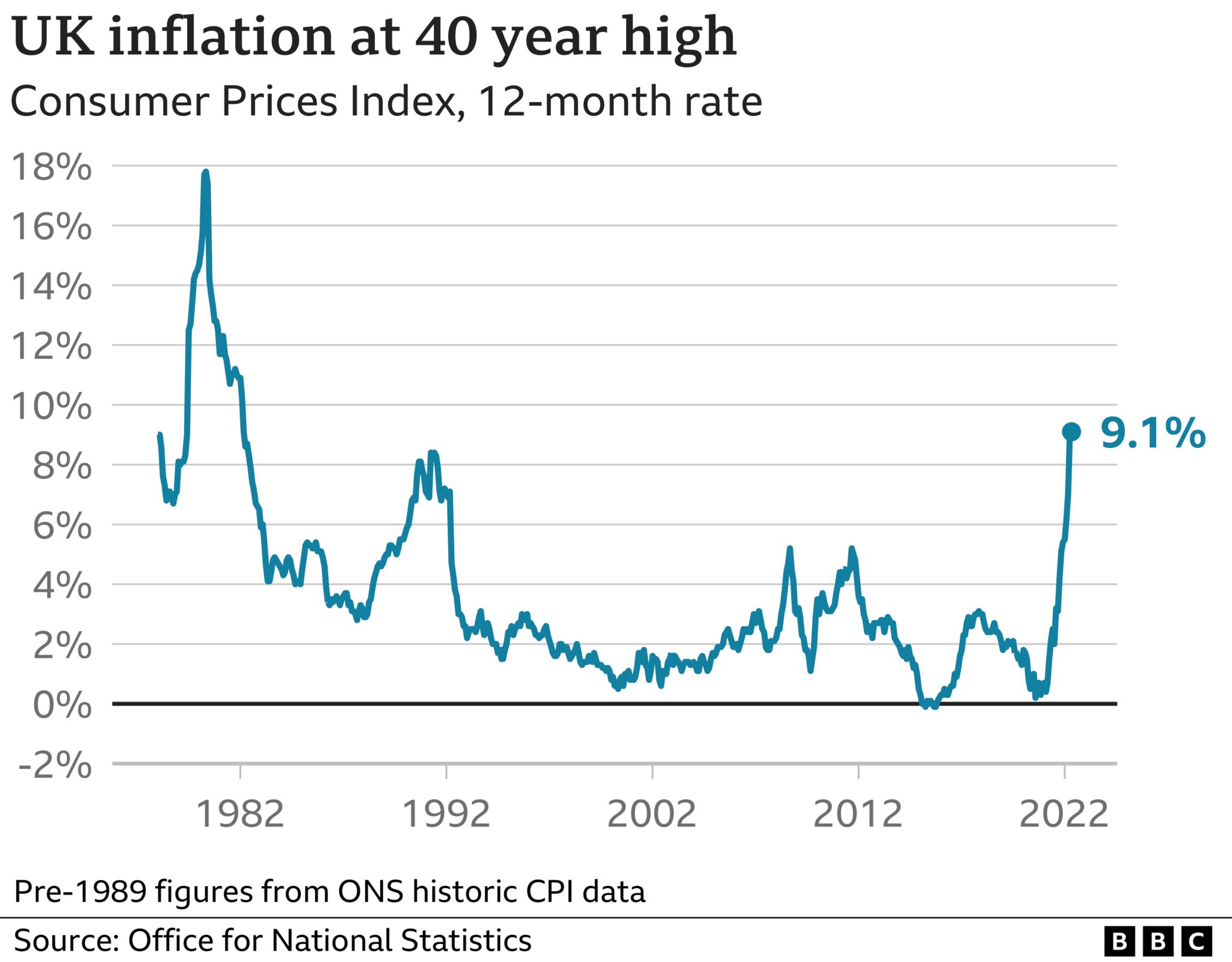

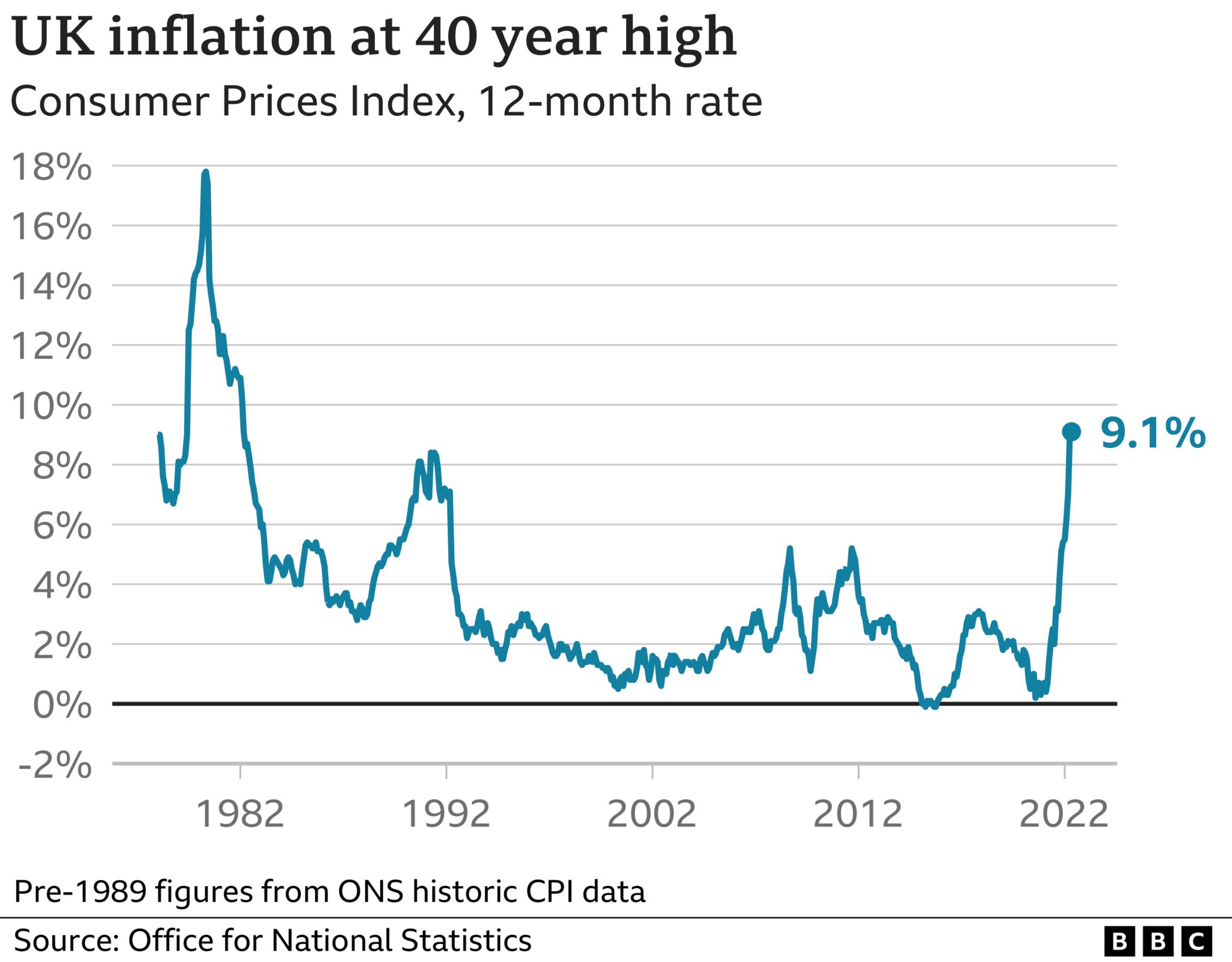

Analyzing UK Inflation Trends: Current Outlook and Projections

Analyzing UK Inflation Trends: Current Outlook and Projections

As the economic landscape continues to evolve, a critical aspect that commands attention is the inflation outlook in the United Kingdom. Examining the current trends and future projections provides valuable insights into the factors influencing inflation in the UK.

Current Economic Indicators:

To understand the inflation outlook, it’s crucial to assess current economic indicators. Key factors such as consumer price indices (CPI), producer price indices (PPI), and wage growth play pivotal roles in shaping the inflation landscape. Analyzing these indicators provides a snapshot of the current economic conditions and their potential impact on inflation.

Impact of Supply Chain Disruptions:

One significant influence on the UK’s inflation outlook is the persistent impact of supply chain disruptions. Disruptions caused by global events, such as the COVID-19 pandemic, have led to shortages, affecting the availability and pricing of goods. Examining how these disruptions ripple through the supply chain helps anticipate their inflationary consequences.

Monetary Policy and Interest Rates:

Central to managing inflation is the role of monetary policy and interest rates. The Bank of England employs these tools to control inflation and stabilize the economy. Analyzing current policies and any adjustments to interest rates provides insights into the government’s strategy to address inflationary pressures.

Consumer Behavior and Spending Patterns:

Consumer behavior and spending patterns are integral components of the inflation outlook. Changes in consumer confidence, purchasing power, and spending habits directly impact demand and, subsequently, prices. Understanding shifts in consumer behavior offers valuable clues about the trajectory of inflation.

Government Fiscal Policies:

Government fiscal policies, including taxation and public spending, also influence inflation. During economic downturns, governments may implement stimulus packages to boost spending, potentially impacting inflation rates. Evaluating current fiscal policies helps gauge their potential effects on inflation in the UK.

Global Economic Factors:

The UK’s inflation outlook is not isolated; it’s intertwined with global economic factors. International events, trade agreements, and geopolitical tensions can all contribute to inflationary pressures. Examining the broader global economic landscape provides a comprehensive perspective on potential influences.

Energy Prices and Their Impact:

Energy prices, particularly oil prices, are key contributors to inflation. Fluctuations in energy prices can have cascading effects on various sectors of the economy. Analyzing the current state of energy prices and their anticipated trajectory aids in understanding their potential impact on inflation in the UK.

Inflation Expectations and Surveys:

Inflation expectations, as perceived by businesses and consumers, play a crucial role in shaping actual inflation. Monitoring inflation expectations through surveys and economic indicators helps in gauging how expectations align with the current economic environment.

Housing Market Dynamics:

The housing market is a significant component influencing inflation in the UK. Fluctuations in house prices and the demand for housing contribute to overall inflation trends. Examining the dynamics of the housing market provides insights into this aspect of the inflation outlook.

Long-Term Economic Trends:

Finally, to comprehensively understand the inflation outlook, it’s essential to consider long-term economic trends. Structural changes in the economy, technological advancements, and demographic shifts can have enduring effects on inflation. Analyzing these long-term trends provides a forward-looking perspective.

In conclusion, delving into the various facets of the UK inflation outlook involves a nuanced analysis of economic indicators, global influences, and long-term trends. To stay informed about the current trends and projections, visit Inflation Outlook UK.