Economic Recession Warning: Navigating Financial Challenges

Navigating Financial Challenges: The Warning Signs of Economic Recession

The global economy is a dynamic system, subject to fluctuations that can have profound impacts on individuals, businesses, and governments. In this article, we will delve into the ominous signs that precede an economic recession, exploring the indicators that experts closely monitor to provide an early warning to the financial community.

Understanding Economic Recession: A Prelude to Turbulent Times

An economic recession is characterized by a significant decline in economic activity, spanning across various sectors. This downturn typically involves a decrease in employment, a contraction in consumer spending, and a general decline in the production of goods and services. Recognizing the warning signs is crucial for proactive measures to mitigate the impact.

Key Indicators of Impending Economic Recession

Several indicators serve as red flags, signaling the possibility of an impending economic recession. These include an inverted yield curve, rising unemployment rates, declining consumer confidence, and a contraction in manufacturing and industrial production. Observing these warning signs allows economists and policymakers to assess the economic health and take preventative action.

Inverted Yield Curve: A Telltale Sign of Economic Distress

One of the most closely watched indicators is the yield curve, specifically its inversion. When short-term interest rates surpass long-term rates, it signals investor concerns about the near future. An inverted yield curve has historically preceded many recessions, making it a potent predictor of economic downturns.

Rising Unemployment Rates: A Symptom of Economic Weakness

Increasing unemployment rates are a clear indication of economic distress. When businesses cut jobs due to reduced demand for goods and services, it has a cascading effect on consumer spending, exacerbating the economic slowdown. Monitoring unemployment figures is crucial for assessing the health of the job market and the broader economy.

Consumer Confidence: A Barometer of Economic Sentiment

Consumer confidence plays a pivotal role in economic stability. During an economic recession, consumers tend to cut back on spending, contributing to a negative feedback loop. Declines in consumer confidence indices serve as early warnings, reflecting the hesitancy of individuals to make significant financial commitments.

Contraction in Manufacturing and Industrial Production

The health of the manufacturing and industrial sectors is integral to economic well-being. A contraction in these areas, marked by a decrease in output and orders, often precedes a broader economic downturn. Observing these trends provides valuable insights into the overall economic trajectory.

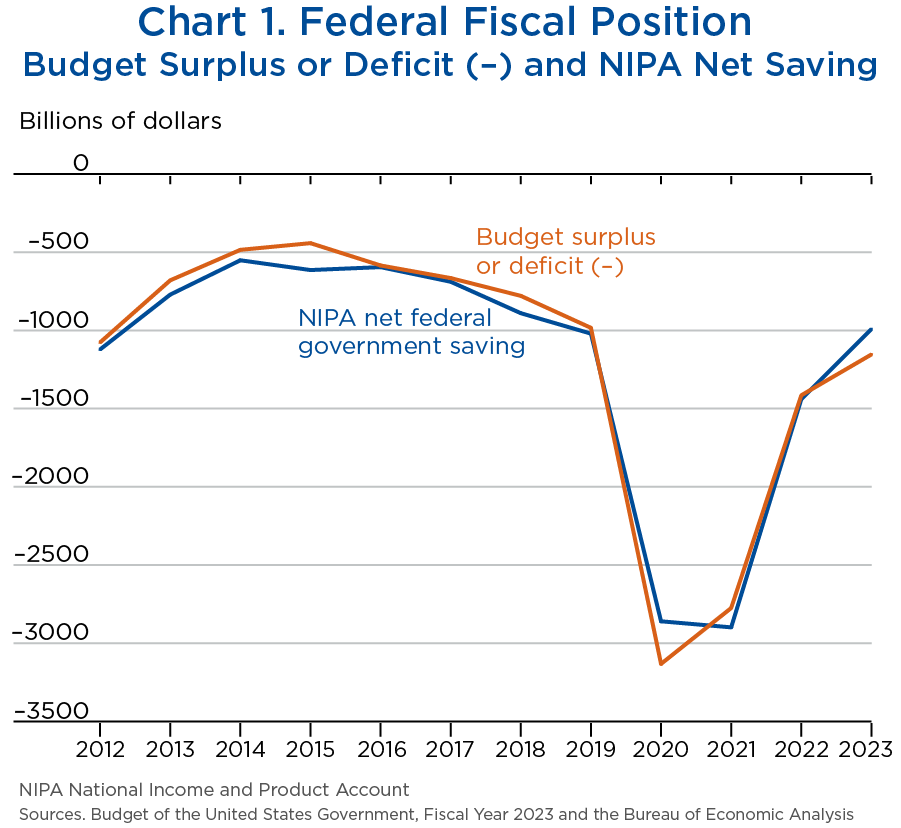

Government Debt and Fiscal Policies: Impact on Economic Stability

The fiscal policies of governments can either mitigate or exacerbate the effects of an economic recession. High levels of government debt, coupled with ineffective fiscal policies, can limit the ability to respond adequately to economic challenges. Monitoring government actions and policies is crucial for understanding their potential impact on economic stability.

Global Economic Factors: The Interconnectedness of Markets

In an era of globalization, the interconnectedness of global markets plays a significant role in economic recessions. Economic downturns in major economies can have a ripple effect across borders. Fluctuations in international trade, currency values, and commodity prices can contribute to or amplify the warning signs of an impending recession.

Financial Markets: Gauging Investor Sentiment

Financial markets are sensitive to economic indicators, and shifts in investor sentiment can be indicative of broader economic trends. Stock market declines, bond market movements, and shifts in commodity prices are closely monitored. Understanding the reactions of financial markets provides additional insights into the overall economic landscape.

Preventative Measures and Mitigation Strategies

Recognizing the warning signs of an economic recession is only the first step. Governments, businesses, and individuals can take preventative measures and mitigation strategies to navigate the challenges effectively. These may include implementing supportive fiscal policies, diversifying investments, and maintaining prudent financial practices.

For a more in-depth exploration of Economic Recession Warning signs, visit here.