Navigating Bank of England Inflation Challenges

Navigating Bank of England Inflation Challenges

The Bank of England plays a pivotal role in managing inflation within the United Kingdom. Understanding the challenges it faces and the strategies employed to navigate inflation is crucial for both policymakers and the public.

Economic Indicators and Decision-Making:

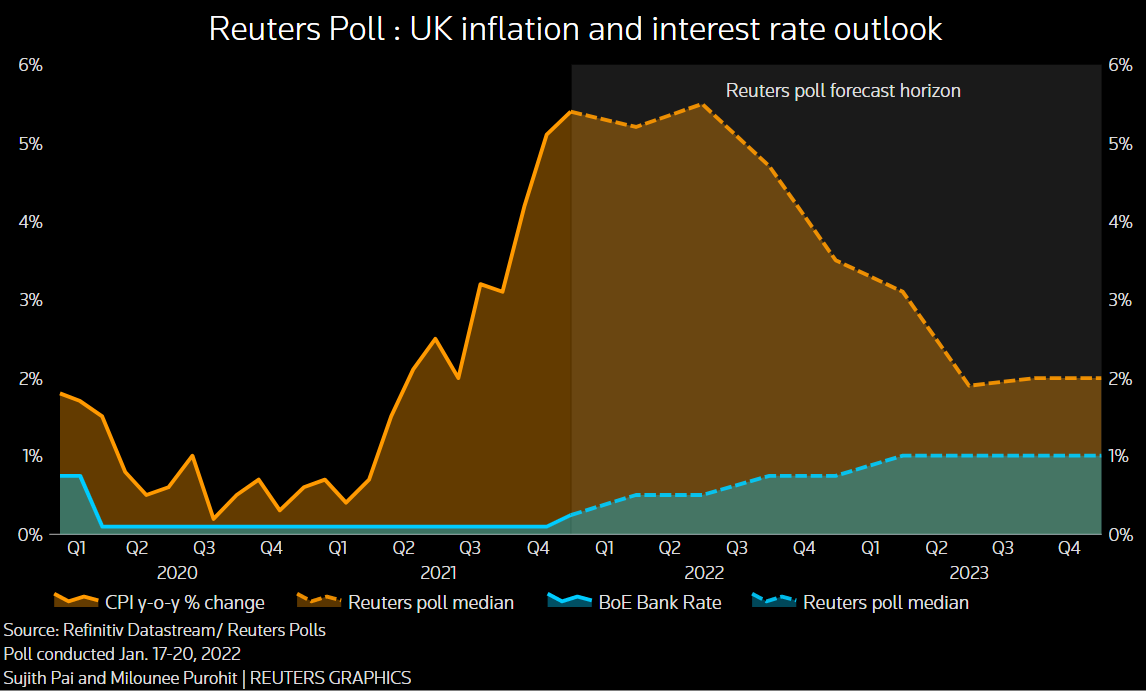

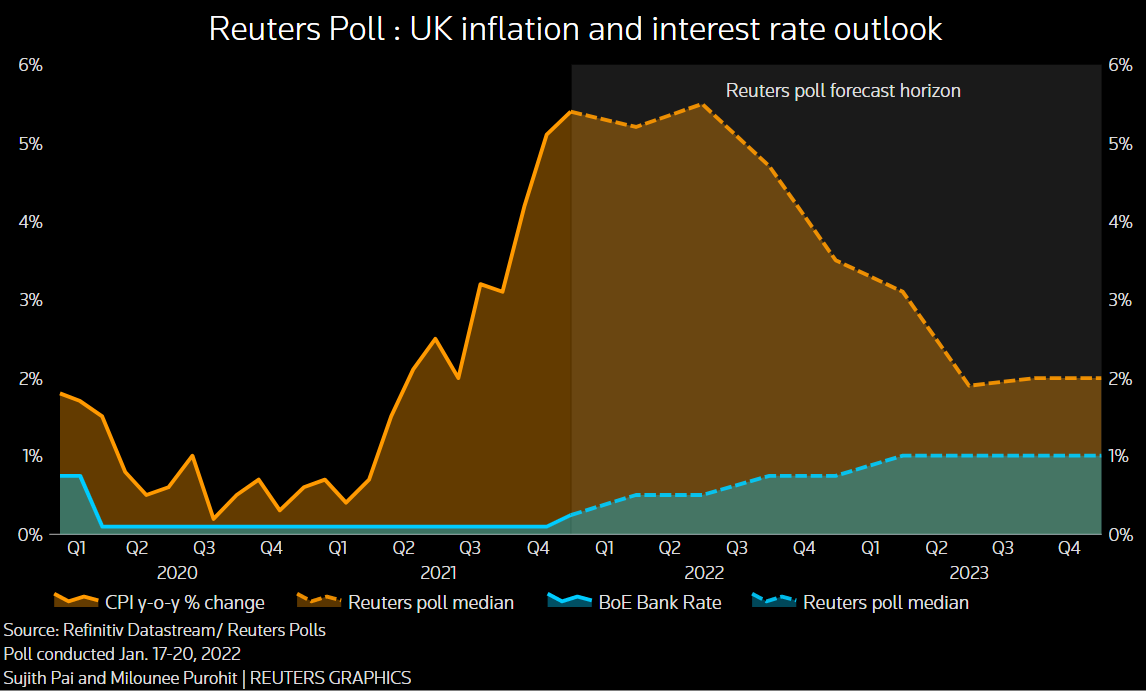

The Bank of England closely monitors economic indicators, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), to gauge inflationary pressures. Decisions on interest rates and monetary policy are often influenced by these indicators. Analyzing the data helps the bank make informed decisions to control inflation effectively.

Global Economic Factors:

In today’s interconnected world, global economic factors significantly impact inflation in the UK. Fluctuations in commodity prices, changes in global demand, and geopolitical events can influence inflation rates. The Bank of England must navigate these external factors to maintain stability in the domestic economy.

Impact of COVID-19:

The COVID-19 pandemic has introduced unprecedented challenges to inflation management. The economic disruptions caused by lockdowns, supply chain interruptions, and changes in consumer behavior have created both deflationary and inflationary pressures. The Bank of England faces the task of steering through these complexities.

Monetary Policy Tools:

The Bank of England employs various monetary policy tools to manage inflation. Adjusting the benchmark interest rate, engaging in quantitative easing, and using forward guidance are among the tools in its arsenal. These tools aim to influence spending, borrowing, and investment, ultimately impacting inflation levels.

Inflation Targets and Communication:

Setting and communicating clear inflation targets are fundamental to the Bank of England’s strategy. Clear communication with the public and financial markets enhances predictability and fosters confidence. Striking a balance between meeting inflation targets and supporting economic growth is a delicate task for policymakers.

Public Expectations and Confidence:

Public expectations and confidence play a crucial role in inflation dynamics. If the public anticipates rising prices, it can influence spending and investment behavior. Managing these expectations and instilling confidence in the bank’s ability to control inflation are essential components of effective monetary policy.

Real Wage Dynamics:

The relationship between inflation and real wages is a critical consideration. High inflation without a corresponding increase in wages can erode purchasing power. Striking a balance to ensure that real wages keep pace with inflation contributes to overall economic stability.

Housing Market Impacts:

The housing market is a significant factor in inflation management. Fluctuations in house prices can have cascading effects on inflation. Addressing issues such as housing supply, demand, and affordability is integral to the Bank of England’s broader inflation control strategy.

Fiscal Policies and Coordination:

Coordination with fiscal policies is vital for effective inflation management. Collaborating with government initiatives, such as fiscal stimulus or austerity measures, contributes to a comprehensive approach. The Bank of England’s coordination with fiscal authorities ensures a unified effort to address economic challenges.

Long-Term Economic Trends:

Considering long-term economic trends is essential for sustained inflation control. Structural changes, technological advancements, and demographic shifts can have lasting effects. The Bank of England’s strategies need to align with these trends to maintain stability and resilience in the face of evolving economic landscapes.

In conclusion, navigating Bank of England inflation challenges requires a multifaceted approach. Monitoring economic indicators, adapting to global dynamics, and employing effective monetary policy tools are critical components. To delve deeper into the complexities of managing inflation, visit Bank of England Inflation.