Navigating Economic Inflation Risks: Strategies for Stability

Economic Headwinds: Unraveling the Dynamics of Inflation Risks

In the ever-evolving landscape of economics, the specter of inflation looms as a significant risk that can impact nations, businesses, and individuals alike. This article delves into the nuances of economic inflation risks, exploring the factors, consequences, and strategies for navigating these challenges.

Understanding Inflation: A Primer on Economic Dynamics

Inflation, in its essence, is the rate at which the general level of prices for goods and services rises, eroding purchasing power. While some level of inflation is a normal part of a growing economy, excessive or rapid inflation poses risks. Understanding the mechanisms that drive inflation is crucial for assessing and addressing the associated risks.

Factors Driving Inflation: Unraveling the Complex Web

Several factors contribute to inflation, and each plays a role in shaping the economic landscape. Demand-pull inflation, cost-push inflation, built-in inflation, and monetary policy are among the key drivers. Dissecting these factors provides insights into the root causes of inflationary pressures and informs strategies for risk mitigation.

Consequences of Inflation: Ripples Across the Economic Spectrum

The consequences of inflation reverberate across various facets of the economy. Purchasing power diminishes as the cost of living rises, impacting households and individuals. Businesses face increased production costs, potentially leading to reduced profit margins. Governments grapple with the challenges of managing inflation to maintain economic stability and public confidence.

Hyperinflation Fears: Navigating Extreme Economic Scenarios

While moderate inflation is expected in a healthy economy, the specter of hyperinflation poses severe risks. Hyperinflation, characterized by extremely rapid and typically uncontrollable price increases, can erode currencies, wipe out savings, and disrupt economic stability. Nations and policymakers must be vigilant to prevent or address hyperinflationary scenarios.

Global Interconnectedness: Inflation in a Hyperconnected World

In today’s globalized economy, the interconnectedness of nations amplifies the impact of inflation risks. Economic events in one part of the world can have cascading effects on global markets. Understanding the dynamics of global economic interconnectedness is vital for anticipating and mitigating inflation risks on an international scale.

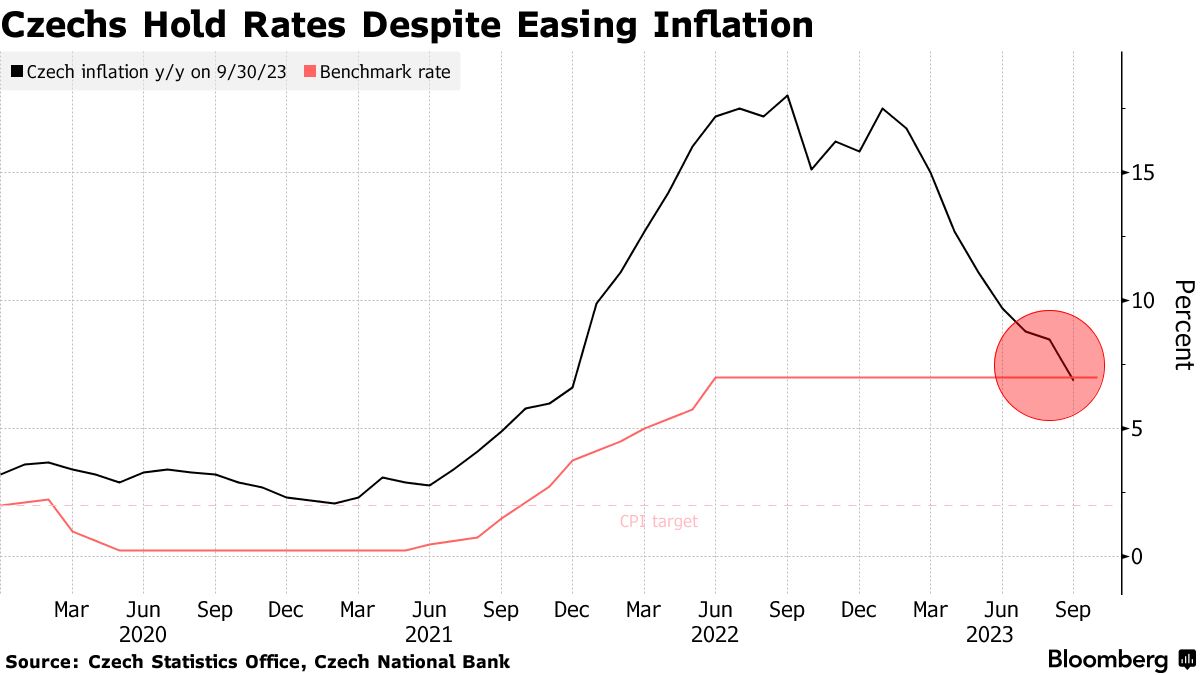

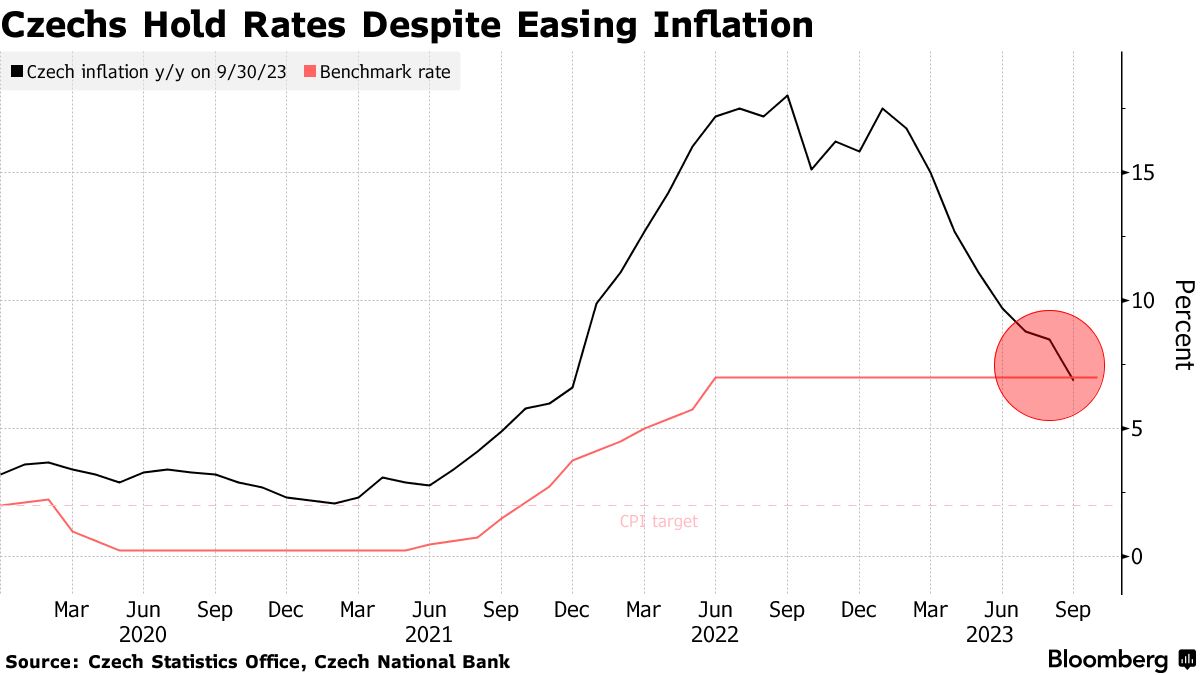

Monetary Policy Measures: A Balancing Act for Central Banks

Central banks play a pivotal role in managing inflation through monetary policy measures. Adjusting interest rates, controlling money supply, and implementing open market operations are tools central banks employ to influence inflation rates. Striking the right balance is crucial, as overly aggressive or conservative measures can exacerbate inflation risks.

Inflation Hedging Strategies: Safeguarding Investments

As individuals and businesses navigate the uncertainties of inflation risks, implementing effective hedging strategies becomes imperative. Diversifying investment portfolios, investing in inflation-protected securities, and exploring commodities are among the strategies to safeguard wealth and mitigate the impact of inflation on financial assets.

Role of Fiscal Policy: Government Intervention in Inflation Management

In addition to monetary policy, fiscal policy plays a vital role in managing inflation risks. Governments can employ fiscal measures such as taxation, public spending, and debt management to influence inflation levels. Coordinated efforts between fiscal and monetary policies are essential for achieving comprehensive and effective inflation management.

Building Economic Resilience: A Collaborative Endeavor

Navigating inflation risks requires a collaborative endeavor involving governments, businesses, financial institutions, and individuals. Building economic resilience involves fostering a culture of transparency, sound financial management, and adaptability. The collective commitment to addressing inflation risks lays the foundation for a more stable and resilient economic future.

Explore Strategies for Stability: Economic Inflation Risks

As the economic landscape continues to evolve, staying informed about strategies for stability in the face of inflation risks is paramount. Explore more about Economic Inflation Risks to gain insights into the latest developments, risk management strategies, and proactive measures to navigate the complexities of inflation in today’s dynamic economic environment. The journey towards economic stability begins with knowledge and a collective commitment to addressing the challenges posed by inflation risks.