Navigating Economic Inflation Trends: Strategies for Stability

Introduction

In the dynamic landscape of economics, understanding and navigating economic inflation trends is crucial for individuals and businesses alike. This article explores the current trends in economic inflation and provides insights into strategies for maintaining stability in the face of inflationary pressures.

Defining Economic Inflation

Economic inflation is the sustained increase in the general price level of goods and services over time. This section provides a concise definition of inflation and highlights its impact on purchasing power, interest rates, and overall economic dynamics.

Causes of Inflation

Several factors contribute to inflation, and this section delves into the primary causes. From demand-pull inflation to cost-push inflation, understanding these forces helps in grasping the nuances of inflation trends.

To explore more about Economic Inflation Trends, visit here. This resource provides additional insights and resources on the latest trends and economic strategies.

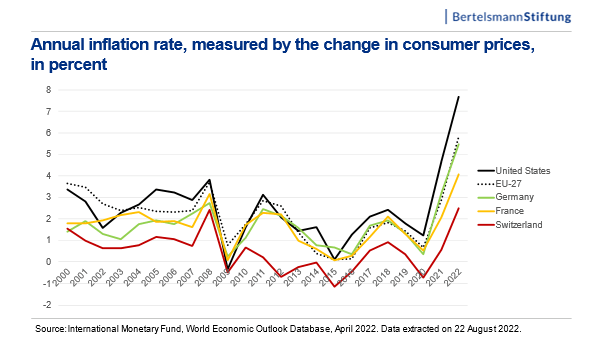

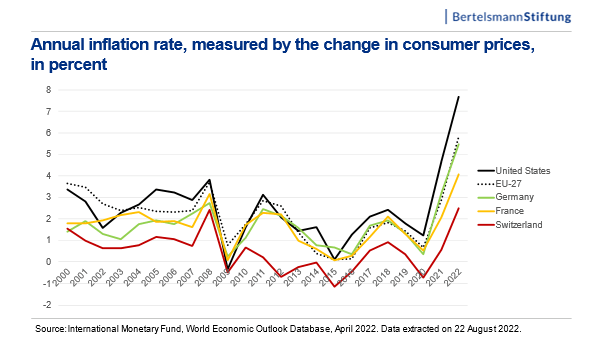

Measuring Inflation: Key Indicators

Measuring inflation involves tracking key indicators such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). This section explores these indicators and their significance in gauging inflation trends.

Impact of Inflation on Consumers

Inflation has direct consequences on consumers, affecting their purchasing power and cost of living. This section discusses how inflation influences consumer behavior, budgeting, and financial decision-making.

Business Implications of Inflation

Businesses also feel the impact of inflation, from rising operational costs to changes in consumer demand. This section explores how businesses can adapt to inflationary trends and implement strategies to maintain profitability.

Government Responses to Inflation

Governments play a crucial role in addressing inflation through monetary and fiscal policies. This section discusses common government responses to inflation, including interest rate adjustments and fiscal stimulus measures.

Investment Strategies in Inflationary Environments

Inflationary environments pose challenges and opportunities for investors. This section explores investment strategies that can help investors navigate and even capitalize on economic inflation trends.

Real Assets as Inflation Hedges

Real assets, such as real estate and commodities, often serve as effective hedges against inflation. This section delves into the rationale behind considering real assets as a strategy for protecting wealth in inflationary periods.

Preparing for Economic Uncertainty

Given the uncertainty associated with economic inflation, preparation becomes paramount. This section provides practical tips for individuals and businesses to prepare for economic uncertainty and mitigate the impact of inflation.

Conclusion

In conclusion, navigating economic inflation trends requires a comprehensive understanding of the factors at play and proactive strategies for individuals and businesses. By staying informed and implementing prudent financial and investment practices, it is possible to navigate the complexities of inflation and maintain stability in economic landscapes characterized by inflationary pressures.