Navigating Federal Reserve: Tackling Inflation Challenges

Navigating Federal Reserve: Tackling Inflation Challenges

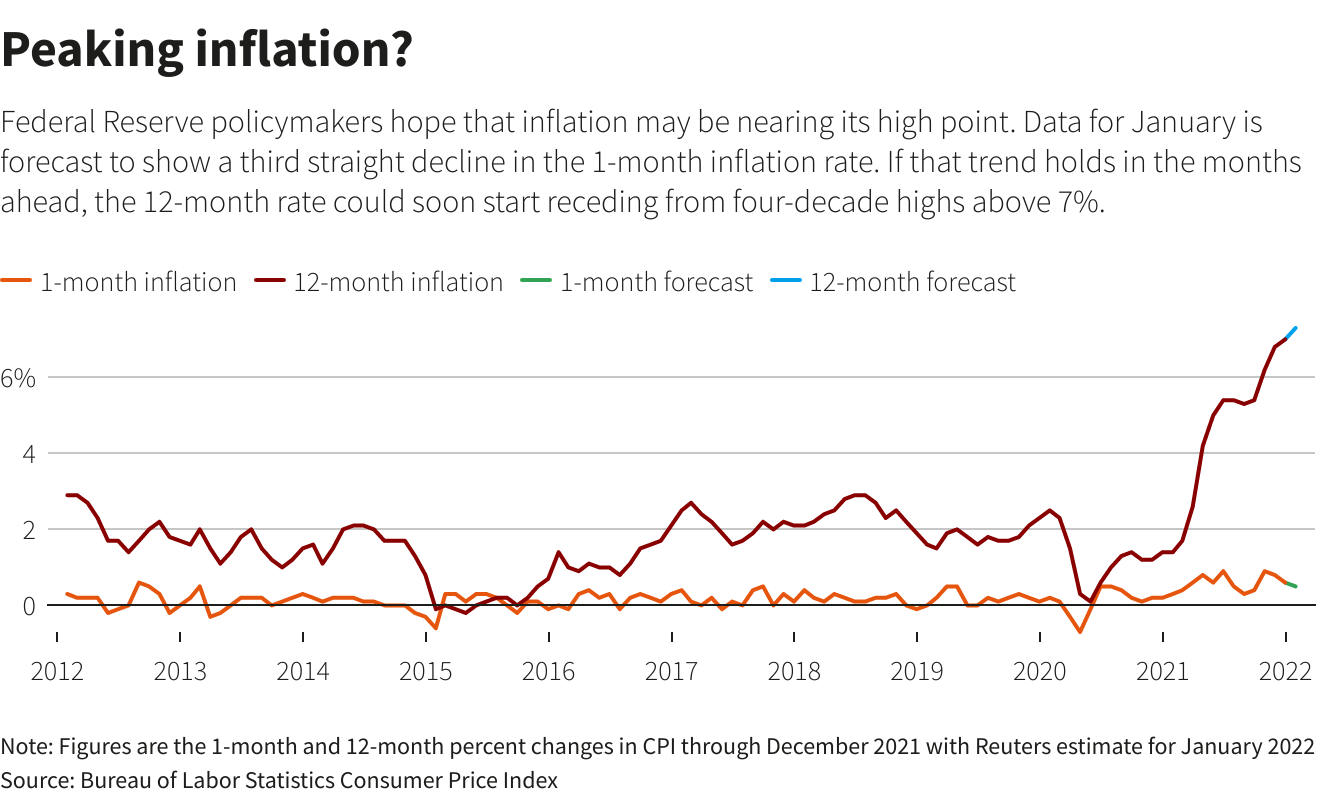

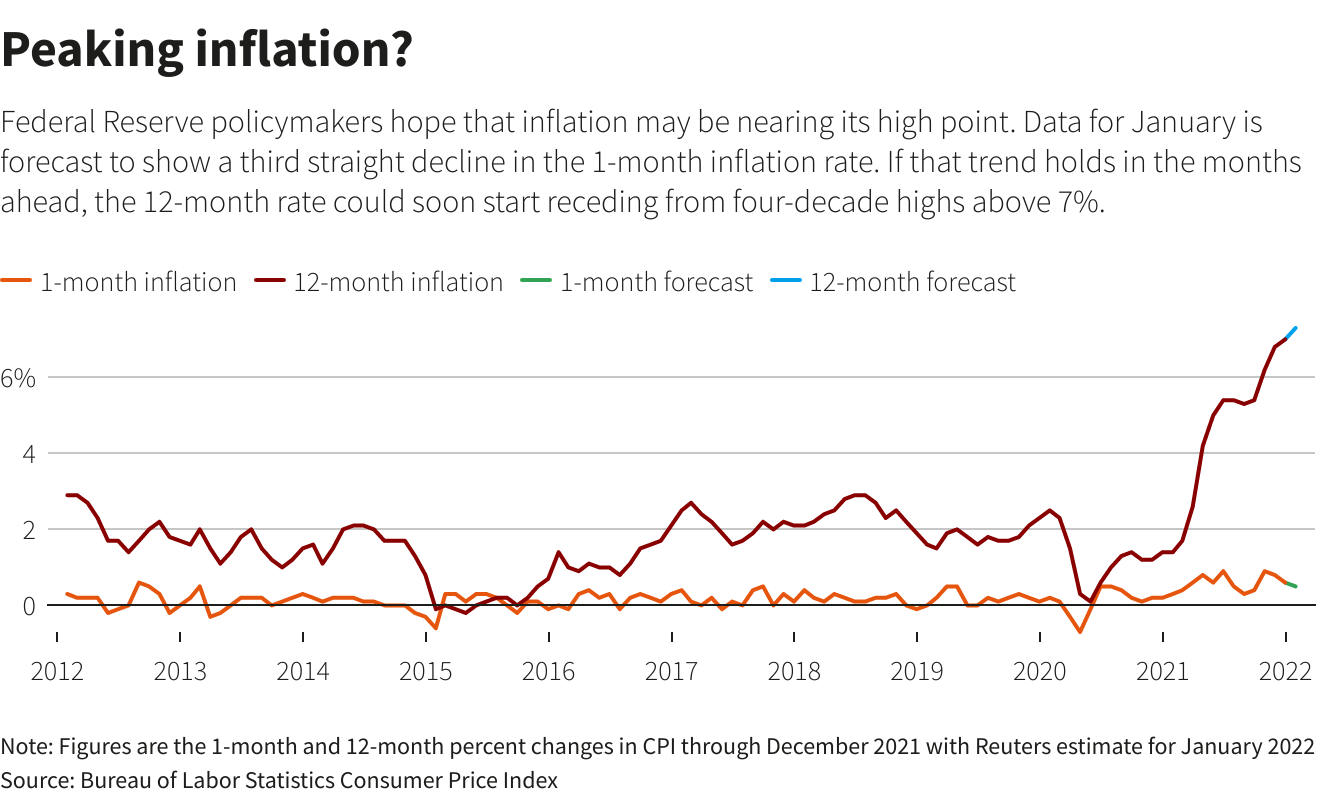

The Federal Reserve plays a pivotal role in the economic landscape, especially in addressing inflationary challenges. In this article, we explore the dynamics of inflation, the role of the Federal Reserve, and strategies employed to navigate this complex economic phenomenon.

Understanding Inflation:

Inflation, the rise in the general price level of goods and services, impacts economies worldwide. Understanding its causes and effects is essential. Factors like increased demand, supply chain disruptions, and changes in production costs contribute to inflation. Balancing inflation is crucial for maintaining economic stability.

The Federal Reserve’s Mandate:

The Federal Reserve, often referred to as the Fed, is the United States’ central bank responsible for monetary policy. One of its key mandates is to maintain price stability, which includes managing inflation. The Fed aims for moderate inflation to promote a healthy and sustainable economic environment.

Monetary Policy Tools:

The Fed employs various monetary policy tools to influence inflation. Adjusting the federal funds rate, which affects interest rates throughout the economy, is a primary tool. By raising or lowering interest rates, the Fed aims to control borrowing costs and, consequently, spending and investment levels.

Quantitative Easing:

During economic downturns, the Fed may implement quantitative easing (QE) to stimulate the economy. This involves purchasing financial assets, such as government securities, to increase the money supply and encourage lending. QE is a strategy to combat deflationary pressures but must be managed carefully to avoid excessive inflation.

Inflation Targeting:

The Fed practices inflation targeting, setting a specific inflation rate as a target. While there is no strict target, the Fed generally aims for around 2% inflation. This approach provides transparency and helps anchor inflation expectations, guiding economic actors in their decision-making processes.

Challenges in Inflation Management:

Balancing inflation is challenging, especially amid complex economic conditions. External factors like global economic trends, geopolitical events, and unforeseen shocks can complicate inflation management. The Fed continually assesses these challenges to make informed policy decisions.

Labor Market Dynamics:

The labor market is a significant factor in inflation dynamics. Low unemployment rates can lead to increased demand for goods and services, potentially fueling inflation. Striking a balance between a robust labor market and price stability is a delicate task for the Federal Reserve.

Inflation Expectations:

Managing inflation expectations is crucial. If businesses and consumers expect higher future inflation, they may act in ways that exacerbate inflationary pressures. The Fed communicates transparently to influence expectations, striving to maintain confidence in its ability to manage inflation effectively.

Global Economic Influences:

The interconnectedness of the global economy poses additional challenges for the Federal Reserve. Factors such as exchange rates, international trade dynamics, and global economic trends impact domestic inflation. Coordinating policies with other central banks becomes essential in a globally interdependent economic environment.

The Fed’s Role Beyond Inflation:

While managing inflation is a primary focus, the Federal Reserve’s role extends beyond this mandate. It also seeks to foster maximum employment and stabilize financial markets. The Fed employs a comprehensive approach to address a range of economic objectives for overall economic well-being.

In conclusion, navigating inflation challenges is a delicate task for the Federal Reserve. By employing various monetary policy tools, practicing inflation targeting, and considering a multitude of economic factors, the Fed strives to maintain price stability. To explore more about the Federal Reserve’s role in tackling inflation, visit Federal Reserve Inflation.