Family-Centric Retirement Planning: Building a Secure Future

Family-Centric Retirement Planning: Building a Secure Future

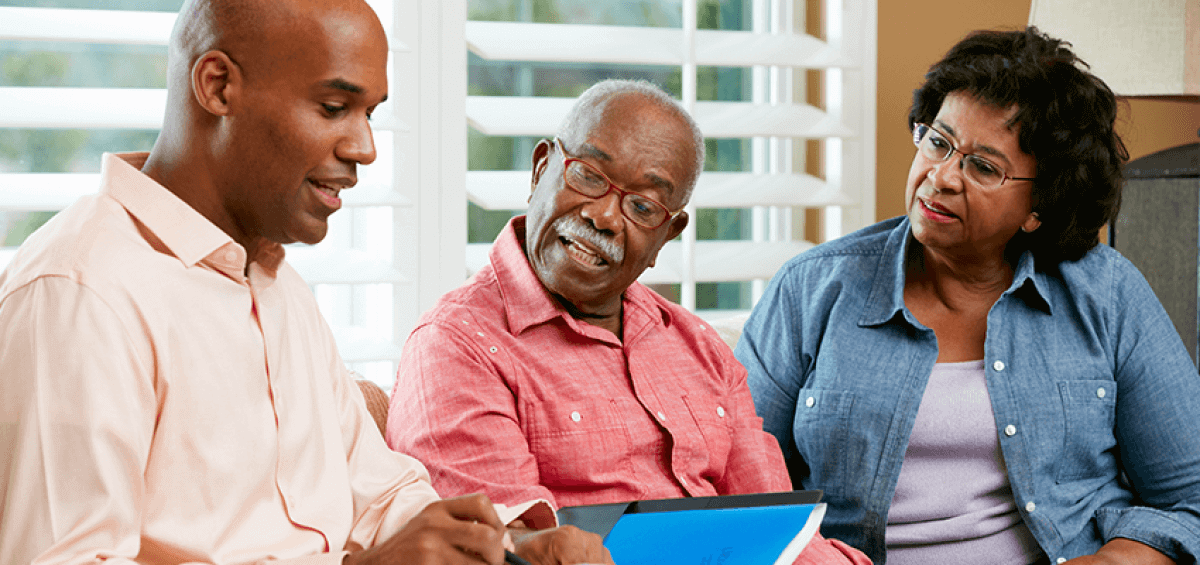

Retirement planning is a family affair, requiring strategic decisions that consider the well-being of each member. This article delves into the importance of family-centric retirement planning, offering insights and strategies to ensure a secure and fulfilling future for all.

Understanding the Collective Vision: Setting Family Goals

Family-centric retirement planning begins with a collective vision. Engage in open discussions with family members to understand their aspirations, financial concerns, and expectations for the future. Establishing shared goals provides a foundation for crafting a retirement plan that aligns with the overall well-being of the family unit.