Unraveling US Inflation Trends: Insights and Implications

Deciphering US Inflation Trends: An In-depth Exploration

The economic landscape of the United States is constantly evolving, and one of the key indicators influencing financial decisions is inflation. In this article, we delve into the intricate web of the US inflationary environment, unraveling trends, insights, and the far-reaching implications for various sectors of the economy.

Understanding the Dynamics of US Inflation

Inflation, the rise in the general level of prices for goods and services, is a phenomenon that can shape economic policies and impact the daily lives of citizens. In the United States, the Consumer Price Index (CPI) is a primary metric used to measure inflation. Understanding the dynamics of how inflation is calculated is crucial for comprehending the broader economic landscape.

Factors Influencing Inflationary Trends

Several factors contribute to the inflationary environment in the US. These include changes in consumer demand, fluctuations in commodity prices, and shifts in global economic conditions. Additionally, monetary policies implemented by the Federal Reserve play a significant role in shaping inflationary trends.

Consumer Behavior and Spending Patterns

The US inflationary environment has a direct impact on consumer behavior and spending patterns. As prices rise, consumers may alter their purchasing habits, leading to changes in the demand for various goods and services. Analyzing these shifts provides valuable insights into the health of the economy and guides businesses in adapting to evolving market conditions.

Challenges for Businesses in Inflationary Periods

Businesses face distinct challenges during inflationary periods. Rising costs of raw materials, energy, and labor can squeeze profit margins. Companies must implement strategies such as cost-cutting measures, pricing adjustments, and innovative operational practices to maintain competitiveness and financial stability.

Investor Considerations and Portfolio Management

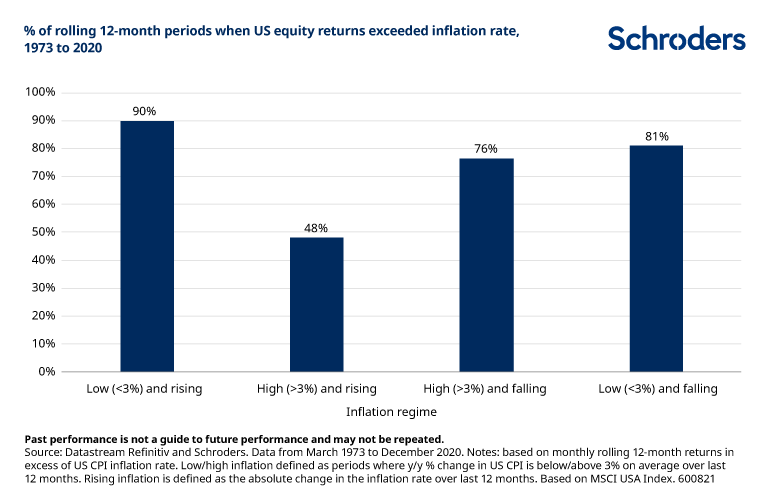

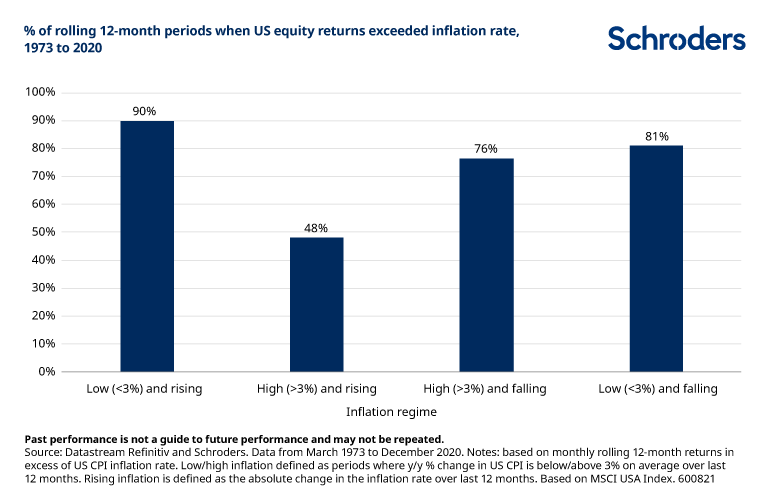

Investors closely monitor inflation trends as they have profound implications for portfolio management. Inflation erodes the real value of money, impacting the returns on investments. Investors may adjust their portfolios by diversifying into assets that historically perform well in inflationary environments, such as commodities and real estate.

Housing Market Dynamics

The US housing market is intricately linked to inflation trends. While inflation can contribute to rising property values, it may also pose challenges for potential homebuyers. Mortgage rates, influenced by inflation and Federal Reserve policies, play a crucial role in shaping the accessibility of housing finance.

Government Policies and Fiscal Measures

Government policies and fiscal measures play a crucial role in managing inflationary pressures. The Federal Reserve employs various tools, including interest rate adjustments and open market operations, to control inflation. Fiscal policies, such as taxation and government spending, also impact the overall inflationary environment.

Impact on Savings and Retirement Planning

Inflation has implications for savings and retirement planning. The erosion of purchasing power over time means that individuals need to factor in inflation when planning for long-term financial goals. Understanding how inflation affects savings helps individuals make informed decisions about investments and retirement contributions.

Global Economic Interconnectedness

The US inflationary environment is not isolated; it is intricately connected to global economic conditions. Factors such as international trade, commodity prices, and geopolitical events can influence inflation trends in the US. Analyzing these global interconnections provides a comprehensive understanding of the forces at play.

US Inflationary Environment: Navigating the complexities of the US inflationary environment requires a nuanced understanding of economic indicators and their implications. Businesses, investors, and individuals must stay informed and adaptive to thrive in the dynamic economic landscape.